how to lower property taxes in texas

Property tax relief that doesnt lower your tax bill. Here we Have Everything you Need.

How To Improve Texas Property Tax System Update Every Texan

Get Record Information From 2022 About Any County Property.

. The steps below will show you how to lower property taxes in Texas so you can move forward with your appeal. You do not owe any property taxes until local elected officials vote for and adopt a tax rateLocal elected officials will meet over the summer. The formula they use follows.

Use the equal and uniform method to justify that your taxable value. What that means is that your property tax rate can vary widely depending on where you choose to live. Texas lawmakers tried to lower property tax bills during their 2019 session and a new report says they put a.

If you have a homestead exemption the state of Texas caps the rise in property taxes. Most local parishes add about 5 for an average total sales tax of about 10. Appeal your property taxes EVERY YEAR.

Assessed value minus exemptions taxable value. Property tax in Texas is a locally assessed and locally administered tax. State laws allow you to file a protest against high property tax if you believe them to be unfair.

Multiply that number by your districts tax rate and you have your property taxes. Ad Look For Texas Property Tax Relief Now. The three factors are used by the county appraisal district to calculate the property tax.

Some do it as a percentage of overall market value others go by replacement cost. This is important because the process. JONES CREEK The aldermen of the village passed a property tax rate for their constituents at a special meeting with only a few days to go before the turnover of the.

Abbott points to rising property valuations in Texas spurred by the states booming real estate market as the reason property taxes have been on the rise deflecting blame from his office. The average effective property tax rate of 169 makes Texas one of the states with the highest property taxes in the United. CAD taxable values are as follows.

Urge taxing units to lower the property tax rates. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand. Property taxes are typically higher in states that have no income tax.

There are generally two ways that Texas homeowners can reduce their property taxes through tax exemptions or protesting their propertys assessed value. On a whim today I looked up a massive rural property on 400. Ad A Full Online Property Taxes Search Only Takes Two Minutes.

File a notice of protest. If not file the exemptions with your county to lower your property taxes. Check assessment notice for inaccuracies.

Find info Here for the US. In order to come up with your tax bill your tax office multiplies the tax rate by. This deficit is then divided by the total property value within a county and this establishes a tax rate for that jurisdiction.

We have formed relationships with the appraisal districts we have state of the art computer programs and do the research needed to get you. Prepare information for hearing. House Bill 3 was an 116 billion school finance bill that included 51 billion to lower school district taxes 65 billion in new.

Property tax brings in the most money of all taxes. This local exemption cannot be less. File a property tax protest.

Every state has slightly different rules and regulations for property. One of the ways to lower your property taxes in Texas is to qualify for any one of the different exemptions available. There is no state property tax.

Texas property taxes are limited to a 10 increase each year but this does not protect new homeowners or commercial properties. Enter an Address to Begin. The Texas Property Tax Cap.

Louisiana has a 445 statewide sales tax rate and local parishes can add up to an additional 7. The homestead exemption allows you to use up to 25000 as tax relief if the property in question is your primary residence. Deficit 1500000 Total Property Value 230800000 Tax Rate.

Your local tax collectors office sends you your property tax bill which is based on this assessment. A thorough review of the Notice of Appraised Value aka. Fight Hard To Have Your Tax Value Reduced.

Why are property taxes in Texas so high. Here are 4 simple actions to take to help your appeal be as successful as possible. If your home is valued at 75000 for example but you have a 10000.

How To Lower Property Taxes in TexasA Complete Guide.

How To Lower Your Property Taxes In Texas

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

New Property Tax Book Available Poconnor Com

Who Doesn T Want To Pay Less In Property Taxes Property Tax Tax Reduction Tax

Highest Property Taxes In Texas Why Are Property Taxes So High In Texas Tax Ease

Texas Has The Fifth Highest Property Taxes In The Nation But Do We Get What We Pay For Candysdirt Com

Lower Taxes Better Texas The Bold Agenda To Reduce Property Taxes Protect Taxpayers And Grow The Economy

Texas Property Tax Reductions Texas Property Tax Reductions Fort Worth Tx

How To Lower Property Taxes Keeping Your Value Low Poconnor Com

/https://static.texastribune.org/media/files/9c31091803542c5a2426bdf599189aa9/REDO%20Longview%20Housing%20File%20MC%20TT%2025.jpg)

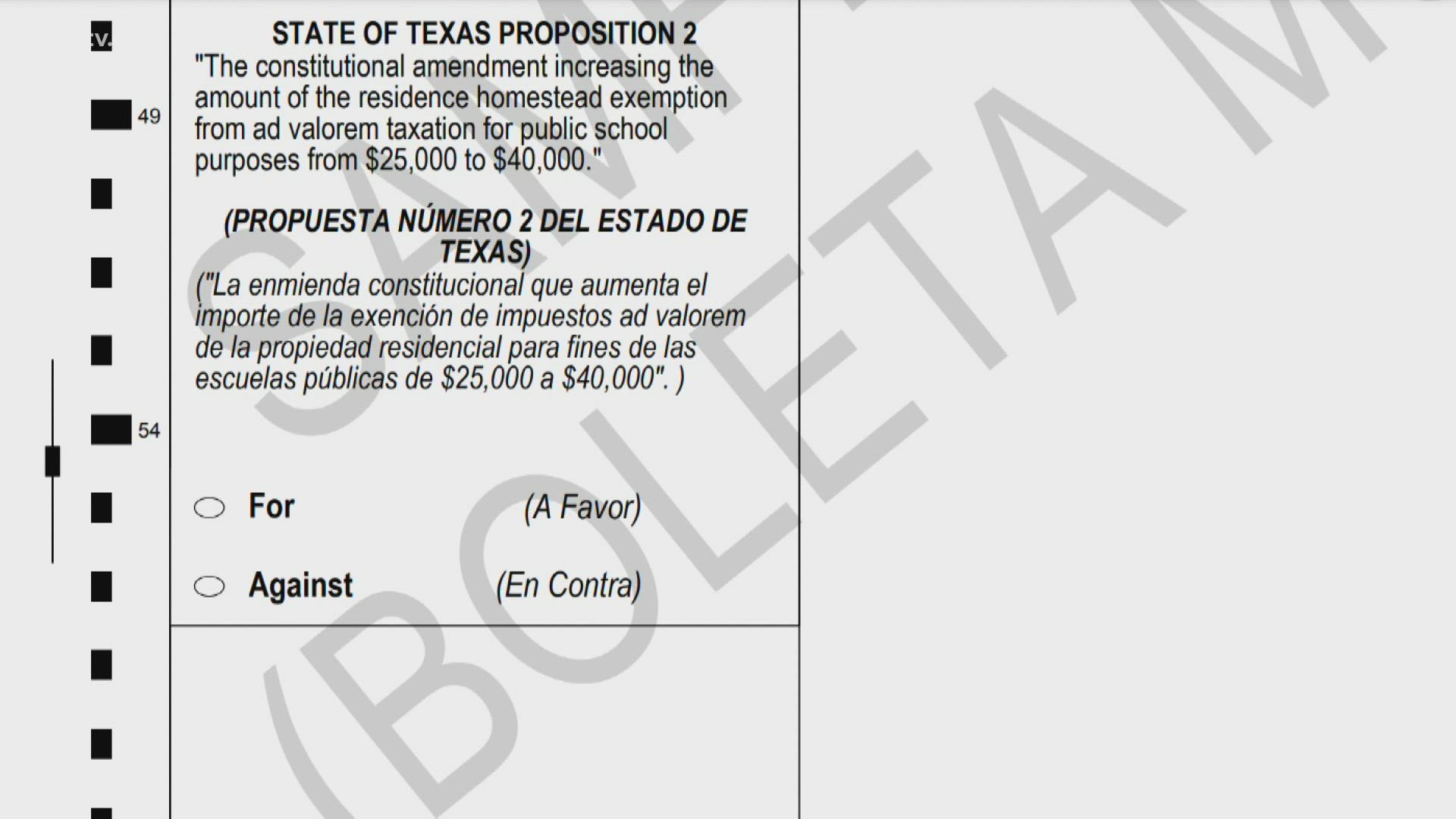

Texas Voters Ok Measures To Trim Property Taxes The Texas Tribune

Homestead Exemptions 101 Jca Realtors North Texas Real Estate Professionals

Tac School Property Taxes By County

/cloudfront-us-east-1.images.arcpublishing.com/gray/QFXFJNZZKZCKJDSSJ5QQTICZIY.jpg)

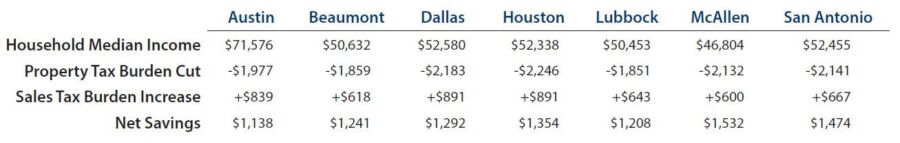

Here S How Two Texas Constitutional Amendments Could Lower Some Property Taxes

![]()

Lower My Texas Property Taxes Llc 38 Connections Dallas Tx

Reduce Texas Soaring Property Taxes By Embracing Sound Budgeting

Texas Property Tax Protest Tips Learn To Reduce Taxes

Propositions That Could Lower Your Property Taxes Kcentv Com