closed end funds leverage risk

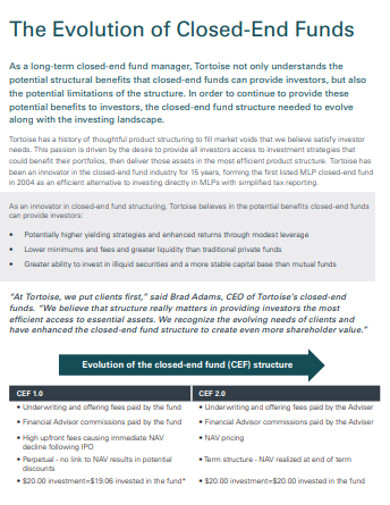

Closed-end funds can offer advisers opportunities to introduce clients to successful portfolio managers and strategies at a discount when prices fall. The term feature ensures NAV liquidity upon maturity.

Closed End Funds Definition Pros Cons Seeking Alpha

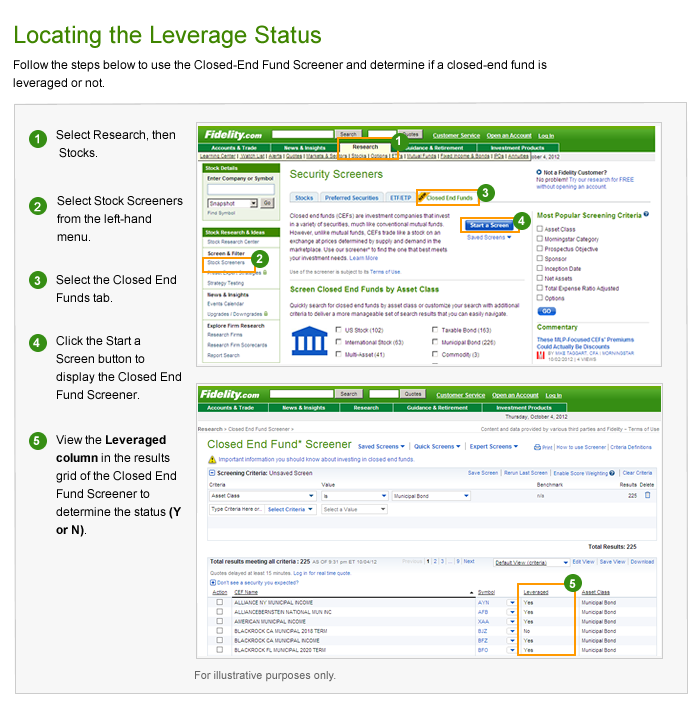

Closed-end funds may use debt or other leverage more than other types of investment companies to purchase their investments.

. The second article in the series explores the role of leverage in closed-end funds. Its holdings are primarily petroleum-centric as opposed to natural gas or NGL. Those shares are listed on a stock exchange and may be traded at any time during the.

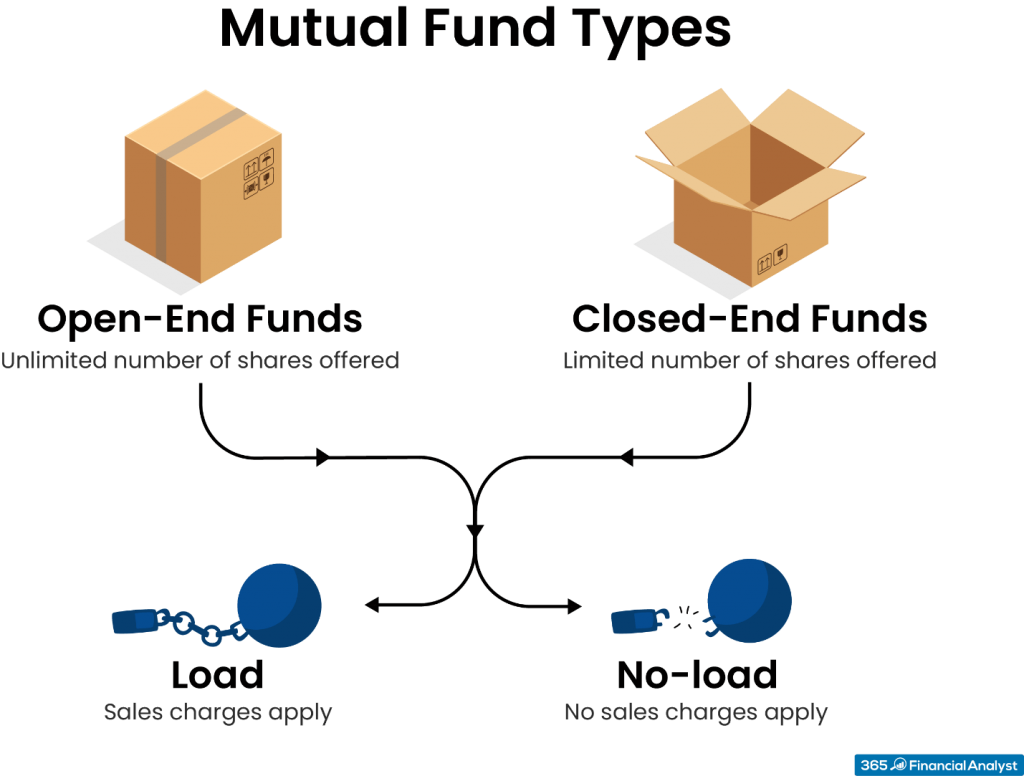

Not all closed-end funds use leverage but most bond CEFs do. Most investors think theyre getting a bond fund with these closed end funds but these are not the safety you. Listed CEFs can offer intra-day liquidity.

A lot of the funds in the closed-end fund space use leverage. Discounts and Leverage Risk in Downturns. Leverage the ability of closed-end funds to issue debt or raise money through the sale of preferred shares is a unique feature of closed-end funds.

Investors lost almost 6 in 2018 13 in 2013 and 23 in 2008. There are also non-listed CEFs with continuous subscriptions and regular typically quarterly. I was a bit surprised to find that in the two categories I examined high-yield fixed income and.

FEI is a closed-end energy infrastructure fund founded in 2012. Its 10-year total return is a loss. What this means for you.

The negative side of the leverage knife can result in an investment death spiral for a highly leveraged closed-end fund. Financial leverage is created whenever closed-end fund common shareholders have investment reward and risk exposure equivalent to more than 100 of their investment capital. Just like discount risk leverage risk tends to amplify price volatility and.

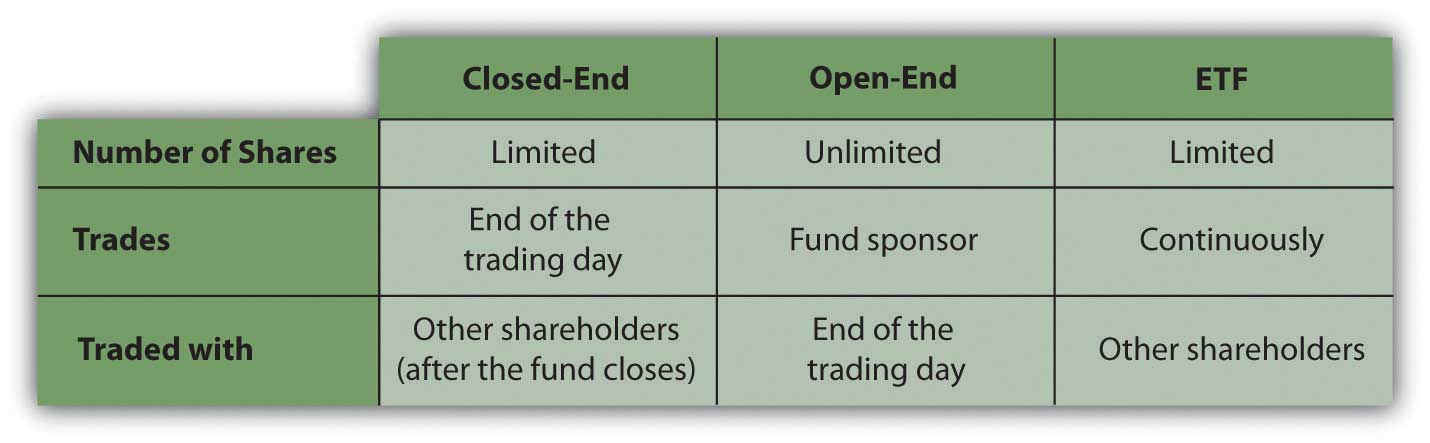

A closed-end fund is organized as a publicly traded investment company by the Securities and Exchange Commission SEC. Fund managers are able to use. Like a mutual fund.

Increasing leverage in a closed-end bond. If interest rate costs get too high the fund will be. Closed-end funds use of.

The shock to the funding of closed-end funds led to an opportunity to explore the connections between funding liquidity risk and market prices. Conversely closed-end funds issue a fixed number of shares usually via an initial public offering IPO. And this was typically historically this has typically been from preferred shares or from debt.

A Lesson On Leverage In Municipal Bond Closed End Funds Vaneck

A Guide To Investing In Closed End Funds Cefs

Closed End Fund Leverage Fidelity

Is It Time To Consider Muni Closed End Funds Blackrock

What Are Mutual Funds 365 Financial Analyst

Understanding Leverage In Closed End Funds Nuveen

Rivernorth Doubleline Strategic Opportunity Fund Inc Opp

Closed End Funds From All Angles

The Problem With Open Ended Life Settlement Funds Articles Advisor Perspectives

The Need For Yield Why Should Asset Managers Consider Launching An Interval Or Tender Offer Fund And What Do They Need To Know Nasdaq

What Are Closed End Funds Forbes Advisor

Closed End Funds 10 Examples Format Pdf Examples

Stable Yield With Closed End Funds Term Cef Ladder Seeking Alpha

A Guide To Investing In Closed End Funds Cefs

What Are Mutual Funds 365 Financial Analyst

Key Concepts Of Closed End Funds Nuveen